Are you talking to yourself now Tero?

US Election 2020

- Sean Hayden

- Microagressor

- Posts: 19325

- Joined: Wed Mar 03, 2010 3:55 pm

- About me: feeling preachy

- Contact:

Re: US Election 2020

We want to support our allies in preserving the freedom and security of Europe, while restoring Europe’s civilizational self-confidence and Western identity.

U.S. White House. (2025) National Security Strategy of the United States of America. ( link )

U.S. White House. (2025) National Security Strategy of the United States of America. ( link )

- Tero

- Just saying

- Posts: 52418

- Joined: Sun Jul 04, 2010 9:50 pm

- About me: 8-34-20

- Location: USA

- Contact:

Re: US Election 2020

You mean state tax? How do you fund stuff? Sales tax? Our state tax is 2.5-6.85%.

- Sean Hayden

- Microagressor

- Posts: 19325

- Joined: Wed Mar 03, 2010 3:55 pm

- About me: feeling preachy

- Contact:

Re: US Election 2020

Yeah, we have no state income tax. We make up for it with higher taxes elsewhere like our sales tax.

We want to support our allies in preserving the freedom and security of Europe, while restoring Europe’s civilizational self-confidence and Western identity.

U.S. White House. (2025) National Security Strategy of the United States of America. ( link )

U.S. White House. (2025) National Security Strategy of the United States of America. ( link )

- Hermit

- Posts: 25806

- Joined: Thu Feb 26, 2009 12:44 am

- About me: Cantankerous grump

- Location: Ignore lithpt

- Contact:

Re: US Election 2020

You mean the Jason Furman, whose appointment to the chair of the Council of Economic Advisers by Obama was opposed by unions and liberal activists? The Jason Furman, who is closely linked to Robert Rubin, career banker for 26 years at Goldman Sachs, eventually serving as a member of the board and co-chairman from 1990 to 1992? The Jason Furman, who speaks approvingly of Walmart's pricing policies while totally ignoring that it comes at great cost to their employees? The Jason Furman, whose appointment met with the GOP's approval? You're claiming that Jason Furman is unlikely to fit the description of people who are sceptical of the study?Sean Hayden wrote: ↑Fri Feb 07, 2020 1:09 amJason Furman, Obama's pick to chair the Council of Economic Advisers is unlikely to fit your description of people who are skeptical of the study.

I am, somehow, less interested in the weight and convolutions of Einstein’s brain than in the near certainty that people of equal talent have lived and died in cotton fields and sweatshops. - Stephen J. Gould

- JimC

- The sentimental bloke

- Posts: 74531

- Joined: Thu Feb 26, 2009 7:58 am

- About me: To be serious about gin requires years of dedicated research.

- Location: Melbourne, Australia

- Contact:

Re: US Election 2020

There is no land tax on your principal residence, only on other properties you may own...pErvinalia wrote: ↑Fri Feb 07, 2020 12:54 amSocialism! We don't pay property taxes here on house value. Only on unimproved land value.

Nurse, where the fuck's my cardigan?

And my gin!

And my gin!

- Tyrannical

- Posts: 6468

- Joined: Thu Dec 30, 2010 4:59 am

- Contact:

Re: US Election 2020

Poor Tero will get added to the 'In memory' when he has a Trump re-election induced heart attack.

Not too late for an intervention and join the Trump train

Not too late for an intervention and join the Trump train

A rational skeptic should be able to discuss and debate anything, no matter how much they may personally disagree with that point of view. Discussing a subject is not agreeing with it, but understanding it.

- Sean Hayden

- Microagressor

- Posts: 19325

- Joined: Wed Mar 03, 2010 3:55 pm

- About me: feeling preachy

- Contact:

Re: US Election 2020

Also Jason Furman or with Jason Furman as chair:

On climate change: a poor choice of analogy on your part it seems.

--//--

On Obamacare, which he helped design.

On family paid leave

On raising minimum wage

On food stamps

On climate change: a poor choice of analogy on your part it seems.

When the Paris Agreement took effect in December 2015, the world took an important step toward avoiding the most dangerous impacts of climate change. But Paris alone is not enough to avoid average global surface temperature increases that climate scientists say are very risky -- additional policies that reduce CO2 emissions are needed, in the United States and elsewhere, to ensure that these damages are avoided.

But we should be clear-eyed about the fact that effective action is possible, and that the economic and fiscal costs of inaction are steep.

--//--

On Obamacare, which he helped design.

--//--Tens of millions of Americans have coverage or have significantly better coverage because of reforms enacted under this Administration. Because of the ACA, an additional 20 million adults now have health insurance. On top of that, more than 3 million children have gained coverage since 2008 due largely to the ACA’s reforms and improvements to the Children’s Health Insurance Program enacted in February 2009. These gains have brought the uninsured rate to its lowest level in history.

On family paid leave

--//--A large body of economic research shows that flexible and family-friendly workplaces provide benefits for workers, businesses, and the economy as a whole. For workers, paid leave and other policies allow them to choose the job best suited to their skills, without restrictions based on potential work-family conflict. Paid leave also increases the probability that a mother continues in her job after having a child, rather than quitting, facilitating her participation in the labor force. Men who have access to paid leave are much more likely to take it than those who can only access unpaid leave.

On raising minimum wage

--//--The Economic Case for Raising the Minimum Wage from White House

The inflation-adjusted value of the minimum wage has fallen by more than a third from its peak and is currently about twenty percent less than it was when President Ronald Reagan first took office in 1981. The minimum wage helps support family incomes, reducing inequality and poverty—especially for female earners. But as the real value of the minimum wage been allowed to erode, it has stopped serving this important purpose. The minimum wage is now just 36 percent of the average wage and trending lower, as those at the low end of the income distribution are in increasing danger of being left behind while the economic recovery continues to unfold.

Raising the minimum wage to $10.10 per hour would benefit a wide range of families. New estimates from the Council of Economic Advisers find that when it is fully phased in 28 million workers would see a raise, including 19 million making less than $10.10 and another 8 million with wages just above $10.10 who would benefit from the ripple effect. These wages increases would be progressive with nearly half of the benefits going to households making under $35,000, but they would also benefit millions of middle class families, for example ones in which a spouse worked part-time at the minimum wage to help the family’s overall income. In total more than half of the workers that benefit are women. Only 12 percent of minimum wage beneficiaries are teenagers and the remainder of the beneficiaries include a wide cross section of families with children, couples, and others.

On food stamps

I'm going to stop here because it's obvious that we should be skeptical of any attempt to smear the guy as a stooge for the wealthy not unlike fossil fuel stooges.As we prepare to celebrate the holidays with family and friends, too many families are struggling with food insecurity. A new report today from the White House Council of Economic Advisers finds that while SNAP is highly effective at reducing food insecurity, benefit levels are often inadequate to sustain families through the end of the month — causing children to go hungry and endangering their health, educational performance, and life chances.

We want to support our allies in preserving the freedom and security of Europe, while restoring Europe’s civilizational self-confidence and Western identity.

U.S. White House. (2025) National Security Strategy of the United States of America. ( link )

U.S. White House. (2025) National Security Strategy of the United States of America. ( link )

- Hermit

- Posts: 25806

- Joined: Thu Feb 26, 2009 12:44 am

- About me: Cantankerous grump

- Location: Ignore lithpt

- Contact:

Re: US Election 2020

Wow! Jason Furman advocates raising the minimum wage to $10.10 per hour. Why, that' almost up to ... Oh. Wait. In 2020, the Department of Health and Human Services set the federal poverty level at $26,200 for a family of four. That's equivalent to $12.38 per hour for a full-time worker. And let's not touch the difference between a living wage and a minimum wage.

Not only that, but he also supports the food stamp program. Our conservative government is experimenting with that too - cards with funds that can only be used for food and some other necessities. Brilliant idea. People are poor because they lack impulse controls and management skills. They'd just use unrestricted funds to but drugs and grog. And it's so much cheaper than social security payments that would enable them to eat and have a beer.

Yes, Jason, stopping where you did was an excellent decision. Lesser intellects would have gone on digging regardless of how deep their holes were already.

I am, somehow, less interested in the weight and convolutions of Einstein’s brain than in the near certainty that people of equal talent have lived and died in cotton fields and sweatshops. - Stephen J. Gould

- Sean Hayden

- Microagressor

- Posts: 19325

- Joined: Wed Mar 03, 2010 3:55 pm

- About me: feeling preachy

- Contact:

Re: US Election 2020

Who's Jason?

I don't think I'm in a hole. You made a claim, I looked into it and found I should be skeptical of it.

I don't think I'm in a hole. You made a claim, I looked into it and found I should be skeptical of it.

We want to support our allies in preserving the freedom and security of Europe, while restoring Europe’s civilizational self-confidence and Western identity.

U.S. White House. (2025) National Security Strategy of the United States of America. ( link )

U.S. White House. (2025) National Security Strategy of the United States of America. ( link )

- pErvinalia

- On the good stuff

- Posts: 61352

- Joined: Tue Feb 23, 2010 11:08 pm

- About me: Spelling 'were' 'where'

- Location: dystopia

- Contact:

Re: US Election 2020

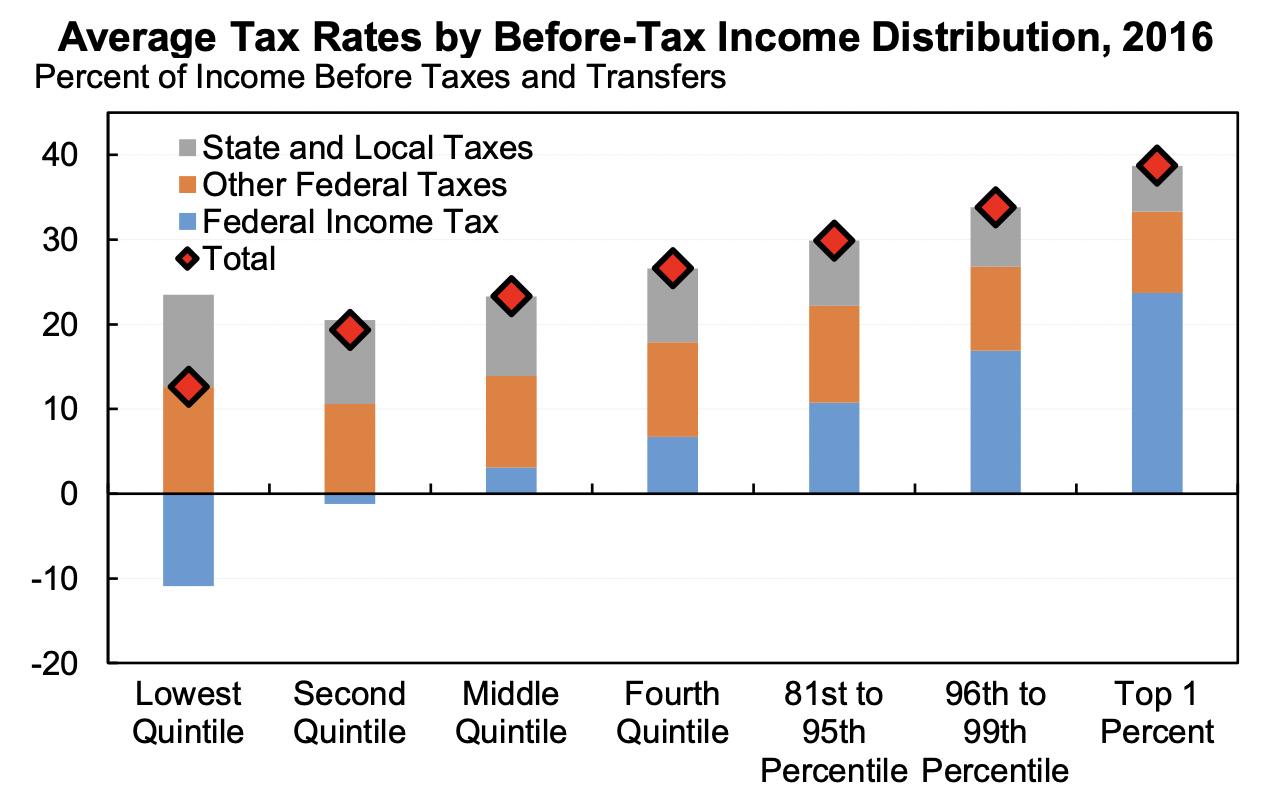

What's clear is that not enough tax is collected. Who's most able to increase their tax remittance? The rich. The same people who have benefitted greatly in the last 30 years of tax cuts.Sean Hayden wrote: ↑Fri Feb 07, 2020 1:09 amJason Furman, Obama's pick to chair the Council of Economic Advisers is unlikely to fit your description of people who are skeptical of the study. A quick search shows he freely admits the rich pay too little in taxes. No, I think the problem is that it is genuinely difficult to get a clear picture here.Hermit wrote: ↑Fri Feb 07, 2020 12:16 amOf course they are. It's par for the course. The same people who dispute those tax data also dispute the data behind this graph:Sean Hayden wrote: ↑Thu Feb 06, 2020 1:43 pmHowever, the assumptions, and some of the data behind the graph Hermit posted have been disputed.

Seeding doubt and confusion ensures average Joe's inability to get it. Here we call it "pulling the wool over one's eyes". Billionaire media owners have the wherewithal to employ lots of henchmen to do just that.Sean Hayden wrote: ↑Thu Feb 06, 2020 1:43 pmIt's not easy for an average Joe to get an accurate picture.

This is a graph Furman came up with in response to yours:

--graph fight!

His main concern was that the study did not include the refundable part of EITC. Others pointed out that most literature differs from Saez-Zucman, some of their sources are missing or incorrectly identified, or that they're using novel interpretations of key figures.

Unfortunately I'm not in a position to evaluate it. So, I said it's hard for the average Joe to get a clear picture.

Sent from my penis using wankertalk.

"The Western world is fucking awesome because of mostly white men" - DaveDodo007.

"Socialized medicine is just exactly as morally defensible as gassing and cooking Jews" - Seth. Yes, he really did say that..

"Seth you are a boon to this community" - Cunt.

"I am seriously thinking of going on a spree killing" - Svartalf.

"The Western world is fucking awesome because of mostly white men" - DaveDodo007.

"Socialized medicine is just exactly as morally defensible as gassing and cooking Jews" - Seth. Yes, he really did say that..

"Seth you are a boon to this community" - Cunt.

"I am seriously thinking of going on a spree killing" - Svartalf.

- pErvinalia

- On the good stuff

- Posts: 61352

- Joined: Tue Feb 23, 2010 11:08 pm

- About me: Spelling 'were' 'where'

- Location: dystopia

- Contact:

Re: US Election 2020

That's not the case everywhere I've owned a property. That's what council rates are made up of mostly.JimC wrote: ↑Fri Feb 07, 2020 2:39 amThere is no land tax on your principal residence, only on other properties you may own...pErvinalia wrote: ↑Fri Feb 07, 2020 12:54 amSocialism! We don't pay property taxes here on house value. Only on unimproved land value.

Sent from my penis using wankertalk.

"The Western world is fucking awesome because of mostly white men" - DaveDodo007.

"Socialized medicine is just exactly as morally defensible as gassing and cooking Jews" - Seth. Yes, he really did say that..

"Seth you are a boon to this community" - Cunt.

"I am seriously thinking of going on a spree killing" - Svartalf.

"The Western world is fucking awesome because of mostly white men" - DaveDodo007.

"Socialized medicine is just exactly as morally defensible as gassing and cooking Jews" - Seth. Yes, he really did say that..

"Seth you are a boon to this community" - Cunt.

"I am seriously thinking of going on a spree killing" - Svartalf.

- JimC

- The sentimental bloke

- Posts: 74531

- Joined: Thu Feb 26, 2009 7:58 am

- About me: To be serious about gin requires years of dedicated research.

- Location: Melbourne, Australia

- Contact:

Re: US Election 2020

Here in Victoria, council rates (which you have to pay on any property you own) is completely separate to land tax, where only your principal residence is exempt...

Nurse, where the fuck's my cardigan?

And my gin!

And my gin!

- pErvinalia

- On the good stuff

- Posts: 61352

- Joined: Tue Feb 23, 2010 11:08 pm

- About me: Spelling 'were' 'where'

- Location: dystopia

- Contact:

Re: US Election 2020

Are you sure? You must have cheap rates bills.

Sent from my penis using wankertalk.

"The Western world is fucking awesome because of mostly white men" - DaveDodo007.

"Socialized medicine is just exactly as morally defensible as gassing and cooking Jews" - Seth. Yes, he really did say that..

"Seth you are a boon to this community" - Cunt.

"I am seriously thinking of going on a spree killing" - Svartalf.

"The Western world is fucking awesome because of mostly white men" - DaveDodo007.

"Socialized medicine is just exactly as morally defensible as gassing and cooking Jews" - Seth. Yes, he really did say that..

"Seth you are a boon to this community" - Cunt.

"I am seriously thinking of going on a spree killing" - Svartalf.

- JimC

- The sentimental bloke

- Posts: 74531

- Joined: Thu Feb 26, 2009 7:58 am

- About me: To be serious about gin requires years of dedicated research.

- Location: Melbourne, Australia

- Contact:

Re: US Election 2020

No, they're bloody expensive! Our land tax goes to the state government, not the council (we pay it on the property we're about to demolish, which should reduce the rate...)

Nurse, where the fuck's my cardigan?

And my gin!

And my gin!

- pErvinalia

- On the good stuff

- Posts: 61352

- Joined: Tue Feb 23, 2010 11:08 pm

- About me: Spelling 'were' 'where'

- Location: dystopia

- Contact:

Re: US Election 2020

Well in socialist Queensland we pay it on all property. But only based on unimproved land value.

Sent from my penis using wankertalk.

"The Western world is fucking awesome because of mostly white men" - DaveDodo007.

"Socialized medicine is just exactly as morally defensible as gassing and cooking Jews" - Seth. Yes, he really did say that..

"Seth you are a boon to this community" - Cunt.

"I am seriously thinking of going on a spree killing" - Svartalf.

"The Western world is fucking awesome because of mostly white men" - DaveDodo007.

"Socialized medicine is just exactly as morally defensible as gassing and cooking Jews" - Seth. Yes, he really did say that..

"Seth you are a boon to this community" - Cunt.

"I am seriously thinking of going on a spree killing" - Svartalf.

Who is online

Users browsing this forum: No registered users and 21 guests